|

Grab your copy of ‘Currency Trading for dummies’ today. Trade currencies like a seasoned pro with this friendly, fact-filled guide to the Forex market. |

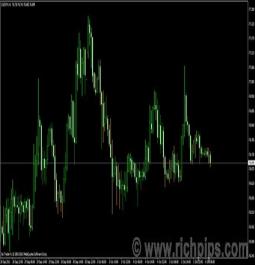

bbsqueeze_dark.mq4

The bbsqueeze.mq4 is a custom indicator designed for use in MetaTrader 4 (MT4), a popular trading platform for forex trading. This indicator utilizes the Bollinger Bands and Keltner Channels to identify potential price squeeze patterns, which can be indicative of upcoming volatility or price breakout.

Key Features:

-

Indicator Type:

- It operates in a separate window from the main price chart.

- The indicator uses six buffers, each representing different parts of the squeeze strategy:

- upB and loB represent the Bollinger Bands' upper and lower limits.

- upK and loK represent the Keltner Channels' upper and lower limits.

- upB2 and loB2 are used for plotting additional values for bullish and bearish trends.

-

Input Parameters:

bolPrd(Bollinger Period) andbolDev(Bollinger Deviation): Control the configuration of Bollinger Bands.keltPrd(Keltner Period) andkeltFactor: Adjust the Keltner Channel settings.momPrd(Momentum Period): Period for momentum calculations used in trend detection.

-

Buffers:

- The upB and loB buffers plot histograms based on the Bollinger Bands.

- The upK and loK buffers display arrows on the chart when certain conditions are met.

- The upB2 and loB2 buffers serve as additional histograms to enhance visual clarity.

-

Calculation Logic:

- The main logic of the indicator is built around Linear Regression and Standard Deviation.

- A squeeze occurs when the Bollinger Bands narrow relative to the Keltner Channel. This could signal that a price breakout may follow.

- The Linear Regression function calculates a trendline for the price over a given period, and based on the calculated momentum and standard deviation, it adjusts the signal for the squeeze.

- The Momentum and Bollinger/Keltner squeeze conditions trigger visual indicators (arrows) on the chart to alert the trader to potential trade opportunities.

-

Trading Signals:

- Bullish Squeeze: If the momentum and squeeze conditions are favorable, the indicator may plot arrows suggesting a potential buying opportunity.

- Bearish Squeeze: Similarly, a bearish squeeze can trigger a sell signal with corresponding arrows.

How it Works:

- The indicator is based on two key components:

- Bollinger Bands which represent volatility with respect to the price.

- Keltner Channels which are also used to measure volatility but use an average true range to adjust the channel width.

- When the distance between the Bollinger Bands becomes narrower compared to the Keltner Channels, it suggests a potential price breakout. The bbsqueeze.mq4 highlights this situation with visual cues such as arrows or histograms.

- Additionally, Linear Regression is employed to analyze trends in the market and detect changes in momentum. The slope of the regression line can help identify the prevailing market direction.

This indicator is useful for traders looking for high-probability breakout situations, especially in forex markets where periods of low volatility are often followed by sharp price movements. The combined use of Bollinger Bands, Keltner Channels, and Linear Regression allows traders to spot potential trades before significant price action occurs.

Share Now

| Total Download | (380) |

|---|